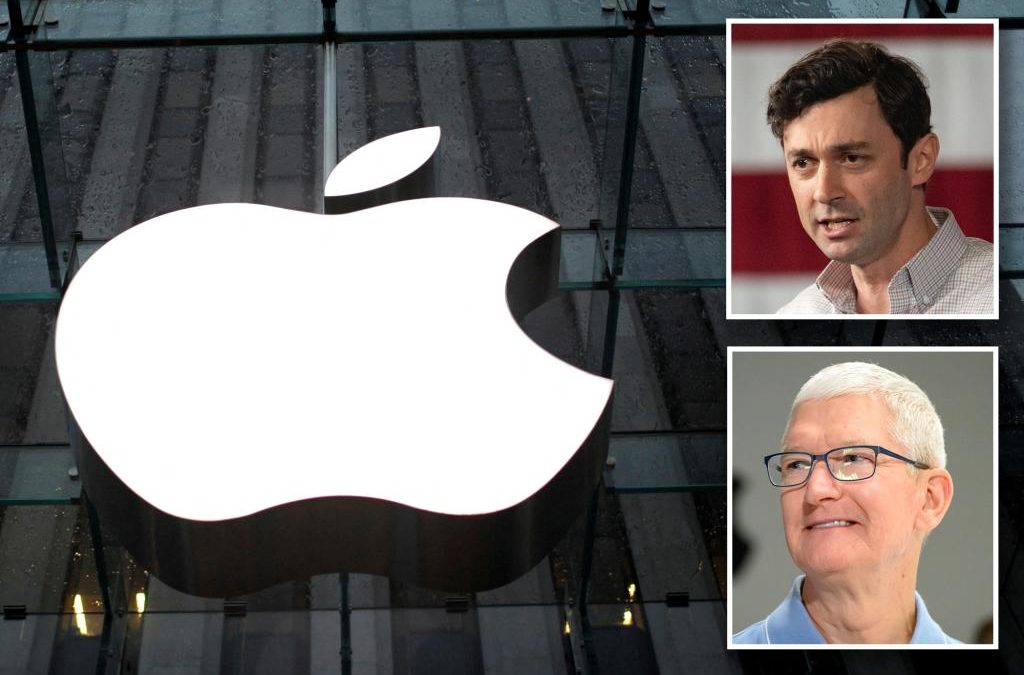

A US lawmaker who has long campaigned against congressional stock trading is among the nearly one-in-five in the Senate who own or likely own chunks of Apple stock – and watchdogs warn the conflicts of interest could derail major legislation aimed at reining in the Big Tech firm’s anticompetitive practices.

Sen. John Ossoff (D-Ga.) – who famously ripped his Republican opponent David Perdue as a “crook” over his personal stock trades during his successful bid for the Senate in 2020 – has portrayed himself as a champion of the movement to ban congressional stock trading.

The Georgia Democrat co-sponsors a bill that would ban members of Congress their spouses or children from trading stocks while in office and require them to place pre-existing assets into a blind trust – or divest them entirely.

However, Ossoff himself owned between $1 million and $5 million in Apple stock prior to setting up his own blind trust in early 2021 – and is likely still a shareholder, even while sitting on the Senate Judiciary Committee responsible for regulating the company.

The issue is getting a fresh spotlight as advocates push for Congressional leadership to reintroduce the Open App Markets Act and the American Innovation and Choice Online Act (AICOA) – two long-stalled bipartisan bills would impose add new restrictions on how Apple and Google operate their controversial app stores.

Both bills advanced out of committee in 2022, but Senate Majority Leader Chuck Schumer never brought them up for a full floor vote.

In both instances, Ossoff voted in favor of advancing the legislation. But behind closed doors, the Georgia Democrat pushed back and raised concerns about the bills, such as the potential harmful effects they could have for user security and data privacy, a source familiar with the process that year said.

While Ossoff is well-known on the Hill as a user privacy advocate, his stance also happened to align with Apple’s arguments against the legislation.

“Having to deal with a senator who regularly repeated Apple talking points – as if it wasn’t obvious they were Apple talking points – was bad enough,” the source said. “But it was even worse that in all likelihood he owned millions of dollars in Apple stock as he was doing it.”

Ossoff only got on board for the votes after some arm-twisting by the bills’ supporters, the source said.

“Ossoff is a walking embodiment of why his bill is weak,” the source added. “His Apple stock demonstrates it.”

When reached for comment, an Ossoff spokesperson declined to comment on the status of his Apple stake, citing the blind trust, and called criticism “laughable” given his public support for reform.

“As first reported by the New York Post, Sen. Ossoff authored the leading legislation to ban stock trading by members of Congress,” the spokesperson said in a statement. “Sen. Ossoff is one of just six senators who has put his stocks in a qualified blind trust, which the Senate Ethics Committee calls ‘the most comprehensive approach’ to ‘eliminate conflicts of interests.’”

“As for the policy, Sen. Ossoff will ask tech companies tough questions on privacy, security, and competition — as he has throughout his tenure,” the spokesperson added. “He will continue thoroughly vetting all proposed legislation.”

The terms of Ossoff’s blind trust require that his trustee disclose if the Apple stake or any other stock has been completely sold off or if its value has fallen below $1,000. So far, no disclosure of that kind has surfaced. Any stock sale would trigger capital gains, meaning Ossoff would become aware of major shifts in his holdings while filing his taxes.

Congress has faced growing calls to implement a stock trading ban in recent years amid revelations of massive personal stock trading windfalls for former House Speaker Nancy Pelosi and others. Proposals by Ossoff, Sen. Josh Hawley (R-Mo.) and others to impose more restrictions generated some buzz – but quickly fizzled out as Congressional leaders declined to pursue them.

Richard Painter, who served as the White House’s chief ethics lawyer under former President George W. Bush, said Ossoff has showed “really bad judgment” by not divesting his Apple stake entirely upon taking office – and dismissed his proposal as ineffective.

“You can’t put Apple stock in a blind trust and pretend you don’t have Apple stock,” Painter told The Post. “This blind trust business, it doesn’t work unless you actually sell the underlying assets. That’s why so few people set up blind trusts for the disposition of major assets. You’ve got to make a decision whether you’re going to sell the assets or not.”

Stock trading is widespread in Congress — with one report finding that nearly 20% of lawmakers had done transactions that presented a conflict of interest with their committee assignments. As of 2021, 53% of lawmakers — 223 representatives and 61 senators — owned stocks, according to a study by the Campaign Legal Center.

Ossoff is one of just a handful of senators who have even taken the step of transferring assets into a blind trust managed by a third party, effectively giving up control of their holdings while in office.

Ossoff’s stock trading bill has drawn endorsements from ethics watchdogs including the Project on Government Oversight, National Taxpayers Union, Taxpayers Protection Alliance, FreedomWorks, and Issue One.

Still, not everyone is convinced that qualified blind trusts are effective.

“Regardless of what he’s said, up and until he is no longer the known beneficiary of this significant investment, it is a conflict of interest,” said Jeff Hauser, executive director of the Revolving Door Project. “Optimally, what would happen is people would divest holdings before entering office, rather than rely on a trust. That is even easier when it is such a liquid asset.”

Donald Sherman, chief counsel for the watchdog group Citizens for Responsibility and Ethics in Washington, agreed, adding, “Even in cases where members of Congress are not engaged in unethical conduct, their ownership interests in companies that they oversee can create an actual or perceived conflict of interest.

“The questions being raised here are exactly why Senators and members of Congress should ban the ownership and trading of individual stock and that any use of blind trusts must be truly blind,” Sherman added.

The Senate Ethics Committee’s own guidelines on qualified blind trusts note that initial holdings “because they are known to the grantor, continue to pose a potential conflict of interest until they have been sold or reduced to a value less than $1,000.”

“Ossoff needs to be able to commit proper oversight and look at the legislation in the way that represent his constituents and not stock trades,” said Garrett Ventry, a Republican and former Senate Judiciary staffer. “Any time you have members with those kinds of holdings, it looks very, very bad.”

If they proceed, the pro-competition bills would represent a major headache for Apple, which was sued by the Justice Department this month for allegedly using illegal tactics to ensure the iPhone’s dominance.

As The Post reported, Apple has enlisted an army of lobbyists whose role in part is to lobby against the renewed consideration of those bills.

Proponents say the competition legislation – which reportedly worried Apple boss Tim Cook enough in 2022 that he personally called senators to lobby against it – could be held up by lawmakers whose personal profits stand to take a hit in the event of a crackdown.

Momentum for other legislation, such as the House-backed measure that could ban TikTok and the bipartisan Kids Online Safety Act, could delay consideration even longer.

Antitrust advocates point out the problem isn’t limited to Ossoff. At least 14 other US senators currently own Apple stock, according to a review of public financial disclosures. The Post reached out to their offices for comment.

Republicans who have disclosed owning shares of Apple include Sens. Kate Britt, Tommy Tuberville, John Boozman, Susan Collins, Markwayne Mullin, Tim Scott, Bill Hagerty and Shelley Moore Capito.

Representatives for Mullin and Boozman each side the investments were managed by independent third parties and in compliance with disclosure requirements. A Capito representative said she and her husband comply with all disclosure requirements.

On the Democratic side, Apple shareholders include Sens. Ossoff, John Hickenlooper, Thomas Carper, Jacky Rosen, Ron Wyden and Sheldon Whitehouse. Angus King, an independent who caucuses with the Democrats, also owns shares.

Despite his holdings, a spokesperson for Whitehouse pointed out that he co-sponsored both AICOA and the Open App Markets Act.

“The Senator and his wife do not trade stocks, and their account manager acts independently without any input from the Senator or his wife per the terms of a formal agreement,” the spokesperson said.

Other than Ossoff, five other senators are known to have assets in blind trusts – Sens. Tammy Baldwin (D-Wis.), John Hoeven (R-ND), Mark Kelly (D-Ariz.), Cynthia Lummis (R-Wyo.), Joe Manchin (D-W.Va.).

Source