The Donald Trump-tied media firm behind “Truth Social” became the most expensive US stock for investors to bet against after surging in its public trading debut – even as finance experts warned it is another highly volatile “meme stock” like AMC or GameStop.

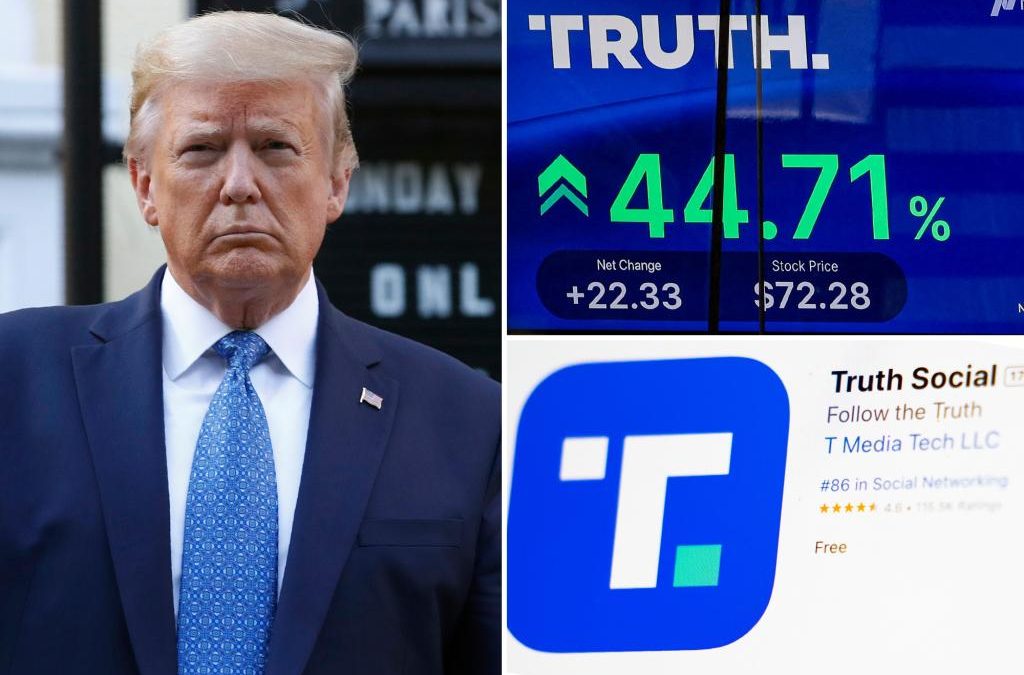

Truth Media & Technology Group, which trades on Nasdaq under the former president’s initials DJT, spiked 16% to $66.77 per share in early trading on Wednesday.

That’s after the stock closed 16% higher to end a wild trading session that saw the shares soar as much as 60% following its public debut via SPAC merger one day earlier.

The stock’s early success — despite Truth Social’s money-losing track record and paltry revenue — has made it an attractive bet for short sellers, who profit when stocks fall by borrowing shares then selling them at a lower price, returning them and pocketing the difference.

“There is huuuuge conviction (Trump pun intended) on the short-side that there will be a significant decline in its stock price in the short term,” said Ihor Dusaniwsky, managing director of predictive analytics at data analytics firm S3 Partners,

As of Tuesday, the Truth Social parent was “the most shorted SPAC in the US” with a whopping $168.6 million of short interest and 3.37 million shares shorted, according to S3.

Short sellers now face annual financing costs of more than 150% to borrow the necessary shares, according to the firm.

“With short sellers staying in this trade even while paying over 250 times the average stock borrow rate for an US short trade and almost 400 times to short [a stock like Apple],” Dusaniwsky added.

The stock’s strong performance in its first day of public trading showed “long shareholders have a much different and much more positive view on DJT\DWAC’s stock price,” he added.

At one point in trading, Truth Social short-sellers have suffered about $61 milllion in mark-to-market losses.

Trump, who faces a wave of legal expenses including a looming $175 million bond payment in his civil fraud case, is now worth more than $7 billion as a result fo the stock surge, according to the Bloomberg Billionaires index.

Despite the initial short squeeze, experts told The Post that Truth Media shares were “untethered from fundamentals” and likely to plunge over the long haul.

The struggling social media firm reported an operating loss of $10.6 million for the first nine months of 2023 on revenue of just $3.4 million. In a recent SEC filing, Truth Social executives said the firm “expects to incur operating losses for the foreseeable future.”

Truth Social had an estimated base of just 494,000 monthly active users for its mobile app in February – a 51% decline compared to the same month one year ago, according to data compiled by analytics firm Similarweb.

“It definitely is the latest meme stock,” said Jay Ritter, a University of Florida finance professor and expert on IPOs, who predicted it was only a matter of time before the stock fell to a measly $2.

The company’s steep stock price could entice more short-sellers to take the plunge.

“At these high stock price levels, which have hit year-to-date highs, we will probably see new short sellers try and jump into this trade hoping for a short-term pullback back into the $30’s or lower,” Dusaniwsky said. “Shorts that have been squeezed out of this trade will be replaced by new short sellers at what they see as new attractive entry points on the short side.”

Source