Artificial-intelligence semiconductor powerhouse Nvidia on Monday unveiled a flagship AI chip, the Blackwell B200, saying it is up to 30 times speedier than its previous chip.

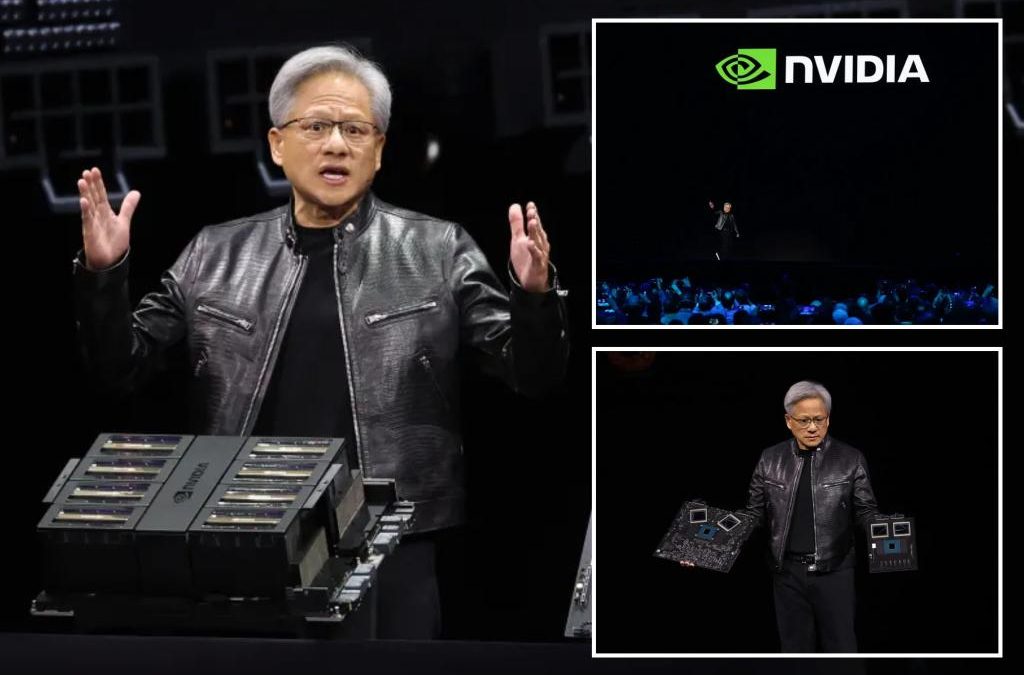

Chief Executive Jensen Huang, kicking off the company’s annual developer conference, also launched a new set of software tools designed to help developers sell their artificial-intelligence models more easily to any company that uses Nvidia.

Nvidia’s chip and software announcements at GTC 2024 will help determine whether the company can maintain its leadership position as the dominant seller of AI equipment. Nvidia had a roughly 80% share of the data center AI chip market last year.

“I hope you realize this is not a concert,” Huang, wearing his trademark black leather jacket, said after taking the stage, in a nod to the rising profile of his company.

The B200 takes two chips the size of Nvidia’s previous offering and binds them together into a single chip.

The new chip has 208 billion transistors, more than double the 80 billion on the company’s previous chip. All of those transistors can access the memory attached to the chip at nearly the same time, improving productivity.

Tom Plumb, CEO and portfolio manager at Plumb Funds, which has Nvidia as one of its largest holdings, said the Blackwell chip was not a surprise.

“But it reinforces that this company is still at the cutting edge and the leader in all graphics processing. That doesn’t mean the market is not going to be big enough for AMD and others to come in. But it shows that their lead is pretty insurmountable,” said Plumb.

Insider Intelligence analyst Jacob Bourne said Nvidia could solidify its AI dominance. “However, rivals like AMD, Intel, startups, and even Big Tech’s own chip aspirations threaten to chip away at Nvidia’s market share, particularly among cost-conscious enterprise customers,” he said.

Nvidia said major customers, including Amazon, Alphabet’s Google, Meta Platforms, Microsoft, OpenAI, Oracle and Tesla, are expected to use the new chip.

Nvidia also is shifting from selling single chips to selling total systems. Its latest iteration houses 72 of its AI chips, 36 central processors and contains 600,000 parts and weighs 3,000 pounds.

Though Nvidia is widely regarded as a chip designer, the company has built a significant battery of software products as well.

The new software tools, called microservices, improve system efficiency across a wide variety of uses, making it easier for a business to incorporate an AI model into its work, just as a good computer operating system can help apps work well.

Nvidia’s shares have surged 240% over the past 12 months, making Nvidia the US stock market’s third-most valuable company, behind only Microsoft and Apple.

Nvidia stock dipped 1% in extended trade on Monday, while Super Micro Computer, which makes AI-optimized servers with Nvidia’s chips, fell 4%. Advanced Micro Devices stock dipped nearly 3% during Huang’s keynote address.

Its stellar 12-month rally leaves Nvidia’s stock at risk of plummeting back to earth if the Santa Clara, Calif., company fails to expand its AI business as much as investors expect.

Nvidia’s market share is expected to drop several percentage points in 2024 as new products from rivals such as Intel and Advanced Micro Devices hit the market.

Huang spoke at a Silicon Valley hockey arena to accommodate its largest crowd for its annual conference.

Huang also announced partnerships with design software companies Ansys, Cadence and Synopsys. Shares of the three companies jumped around 3% in extended trade following Huang’s comments.

Source