Enterprise adoption of AI is ready to shift into higher gear. The capabilities of generative AI have captured management attention across the organization, and technology executives are moving quickly to deploy or experiment with it. Many organizations intend to increase their spending on the wider family of AI capabilities and the data infrastructure that supports them by double digits during the next year. And notwithstanding concerns about unfavorable economic conditions, executives see opportunities to leverage data and AI to deliver more growth to their organizations, to both the top and bottom lines.

Based on a global survey of 600 technology leaders and a series of in-depth interviews, this report finds that organizations are sharply focused on retooling for a data and AI-driven future. Everything from data architecture to AI-enabled automation is on the table, as technology executives strive to find new efficiencies and new sources of growth. At the same time, the pressure to democratize the power of data and AI creates renewed urgency to bolster data governance and security.

Following are the study’s key findings:

- CIOs are doubling down on their investments in data and AI. Faced with increasing audience expectations, new competitive pressures, a challenging economic backdrop, and an unprecedented speed of innovation, technology leaders need their data and AI assets to deliver more growth to the business than ever before. They are investing to secure this future: every organization surveyed will boost its spending on modernizing data infrastructure and adopting AI during the next year, and for nearly half (46%), the increase will exceed 25%.

- Consolidation of data and AI systems is a priority. The proliferation of data and AI systems is particularly extensive in the survey’s largest organizations (those with annual revenue of more than $10 billion). Among these, 81% operate 10 or more of these systems, and 28% use more than 20. The executives we interviewed aim to pare down their multiple systems, connecting data from across the enterprise in unified platforms to break down silos and enable AI initiatives to scale.

- Democratization of AI raises the stakes for governance. As business units and their staff clamor to use generative AI, executives seek assurance that governance frameworks for the technology can provide not only the needed data accuracy and integrity but also adequate data privacy and security. That’s probably why 60% of respondents say a single governance model for data and AI is “very important.”

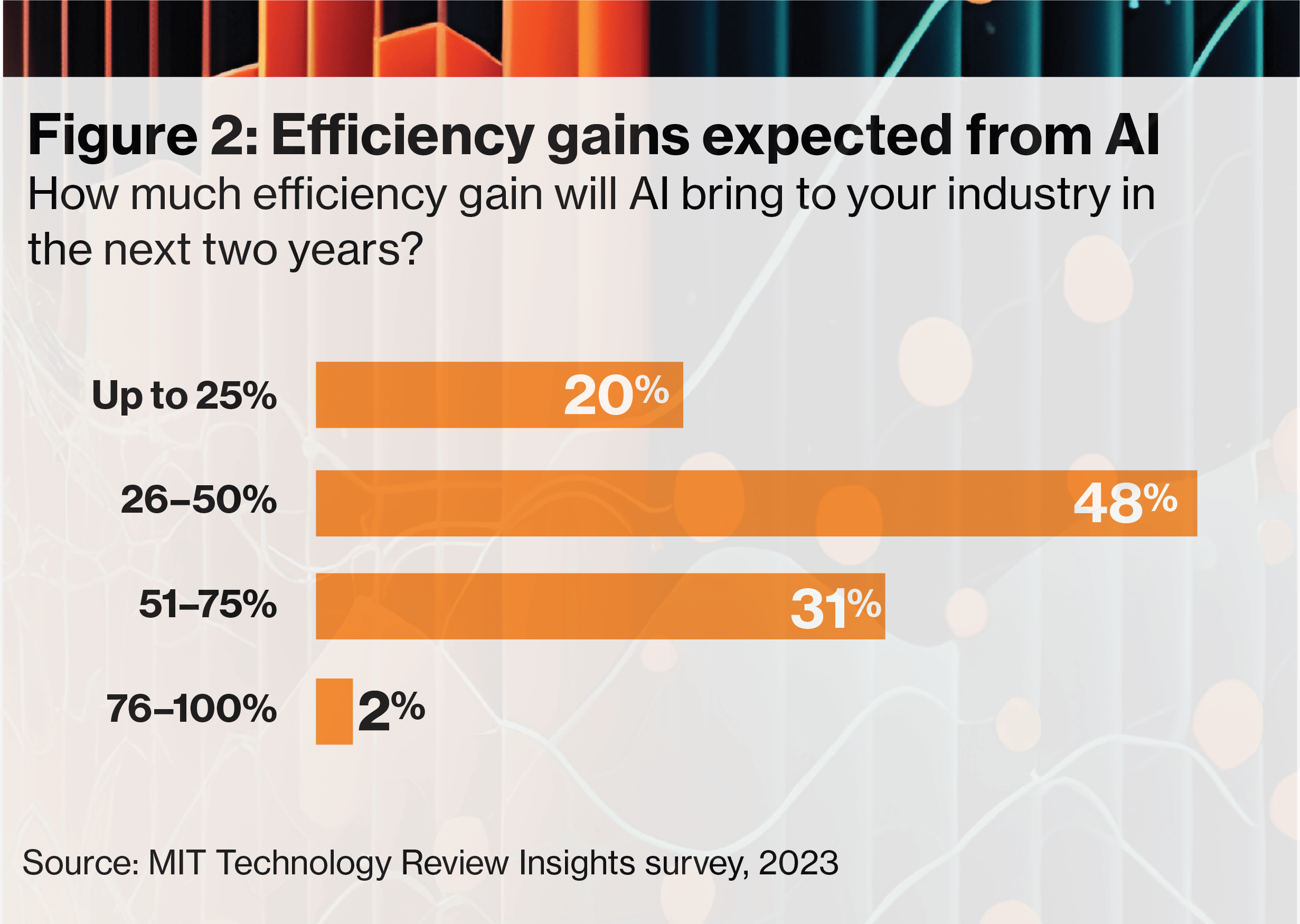

- Executives expect AI adoption to be transformative in the short term. Eighty percent of survey respondents expect AI to boost efficiency in their industry by at least 25% in the next two years. One-third say the gain will be at least 50%.

- As generative AI spreads, flexible approaches are favored. Eighty-eight percent of organizations are using generative AI, with one-quarter (26%) investing in and adopting it and another 62% experimenting with it. The majority (58%) are taking a hybrid approach to developing these capabilities, using vendors’ large language models (LLMs) for some use cases and building their own models when IP ownership, privacy, security, and accuracy requirements are tighter.

- Lakehouse has become the data architecture of choice for the era of generative AI. Nearly three-quarters of surveyed organizations have adopted a lakehouse architecture, and almost all of the rest expect to do so in the next three years. Survey respondents say they need their data architecture to support streaming data workloads for real-time analytics (a capability deemed “very important” by 72%), easy integration of emerging technologies (66%), and sharing of live data across platforms (64%). Ninety-nine percent of lakehouse adopters say the architecture is helping them achieve their data and AI goals, and 74% say the help is “significant.”

- Investment in people will unlock more value from data and AI. In our survey, talent and skills gaps overshadow organizations’ other data and AI challenges. When asked where their company’s data strategy needs to improve, the largest share of respondents (39%) say investing in talent. The number-one difficulty they face with their data and AI platforms, with 40% citing this as a top concern, is training and upskilling staff to use them.

A subsequent report will examine these survey results in detail, accompanied by insights from additional executive interviews across six sectors: financial services, health care and life sciences, retail and consumer packaged goods, manufacturing, media and entertainment, and government.

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.

Article Source link and Credit