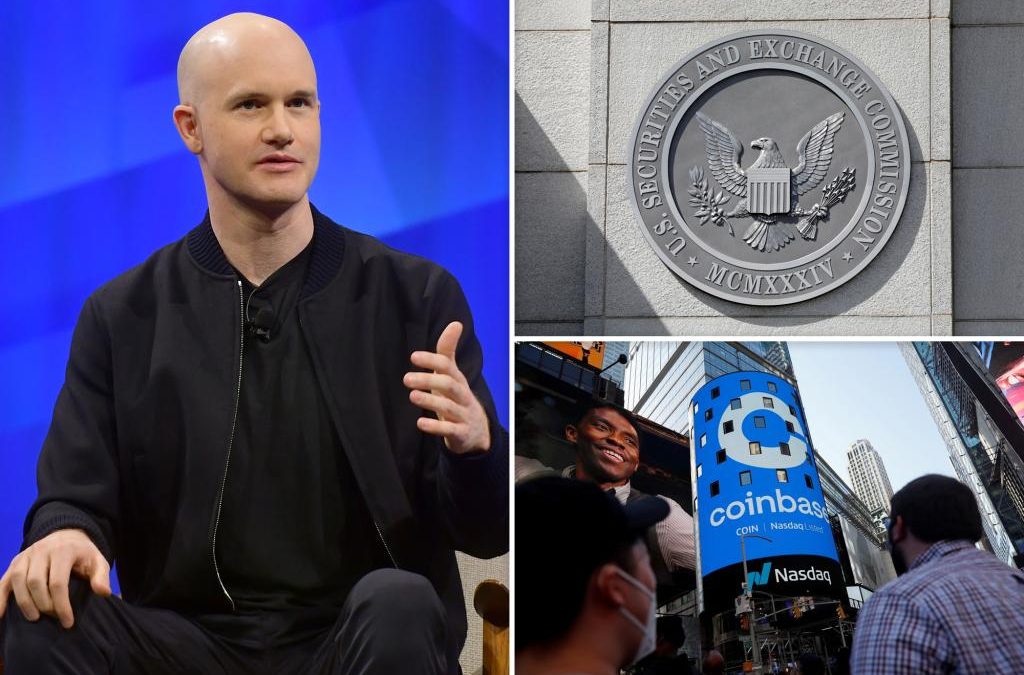

The Securities and Exchange Commission on Tuesday sued Coinbase, accusing the largest US cryptocurrency exchange of operating illegally because it failed to first register with the regulator.

The lawsuit is the SEC’s second in two days against a major crypto exchange, following its case against Binance, the world’s largest cryptocurrency exchange, and founder Changpeng Zhao.

Both civil cases are part of SEC Chair Gary Gensler’s push to assert jurisdiction over crypto markets, which he on Tuesday again labeled a “Wild West” of investing, and protect investors while shoring up their trust in capital markets.

“The crypto markets are undermining that trust, and I would say this: it undermines our overall capital markets,” Gensler told CNBC.

Crypto companies including Coinbase have said SEC rules are unclear, and the regulator is overreaching by asserting oversight of their industry.

Paul Grewal, Coinbase’s general counsel, in a statement said the company will continue operating as usual and has a “demonstrated commitment to compliance.”

Ten states led by California are also taking legal action against Coinbase for alleged securities law violations.

Shares of Coinbase’s parent Coinbase Global were down $8.18, or 13.9%, at $50.53 in late morning trading, after earlier falling as much as 21%.

Coinbase customers pulled more than $57 million from the exchange within a couple of hours of the filing, according to data firm Nansen.

13 crypto assets

In its complaint filed in Manhattan federal court, the SEC said Coinbase has since at least 2019 made billions of dollars by operating as a middleman on crypto transactions, while evading disclosure requirements meant to protect investors.

The SEC said Coinbase traded at least 13 crypto assets that are securities that should have been registered, including tokens such as Solana, Cardano and Polygon.

Founded in 2012, Coinbase recently served more than 108 million customers, and ended March with $130 billion of customer crypto assets and funds on its balance sheet. Transactions generated 75% of its $3.15 billion of net revenue last year.

Tuesday’s complaint addressed several aspects of Coinbase’s business including Coinbase Prime, which routes orders; Coinbase Wallet, which lets investors access liquidity; and the Coinbase Earn staking service.

In the staking program, Coinbase pools crypto assets and uses them to facilitate activity on the blockchain network, in exchange for “rewards” it provides customers after taking a commission for itself.

The states are focused on this program, and New Jersey fined Coinbase $5 million for selling unregistered securities.

‘Can’t ignore the rules’

Tuesday’s SEC lawsuit seeks civil fines, the recouping of ill-gotten gains and injunctive relief.

The SEC had warned Coinbase in March that charges might be coming. It said the company was “fully aware” that its business was subject to federal securities laws, but ignored it.

“You simply can’t ignore the rules because you don’t like them or because you’d prefer different ones,” SEC Enforcement Chief Gurbir Grewal said in a statement.

Gensler’s crypto crackdown has prompted the industry to boost compliance, shelve products and expand outside the country.

Kristin Smith, CEO of the Blockchain Association trade group, disputed Gensler’s claim of jurisdiction over the industry. “We’re confident the courts will prove Chair Gensler wrong in due time,” she said.

In the Binance case, the SEC accused that exchange of inflating trading volumes, diverting customer funds, improperly commingling assets, failing to keep wealthy US customers off its platform, and misleading customers about its controls.

Binance pledged to defend vigorously against the lawsuit, and said the case reflected the SEC’s “misguided and conscious refusal” to provide clarity and guidance to the crypto industry.

Coinbase’s friction with Gensler dates to 2021, when the SEC threatened to sue if Coinbase were to let users earn interest by lending digital assets. The company scrapped the idea.

Source