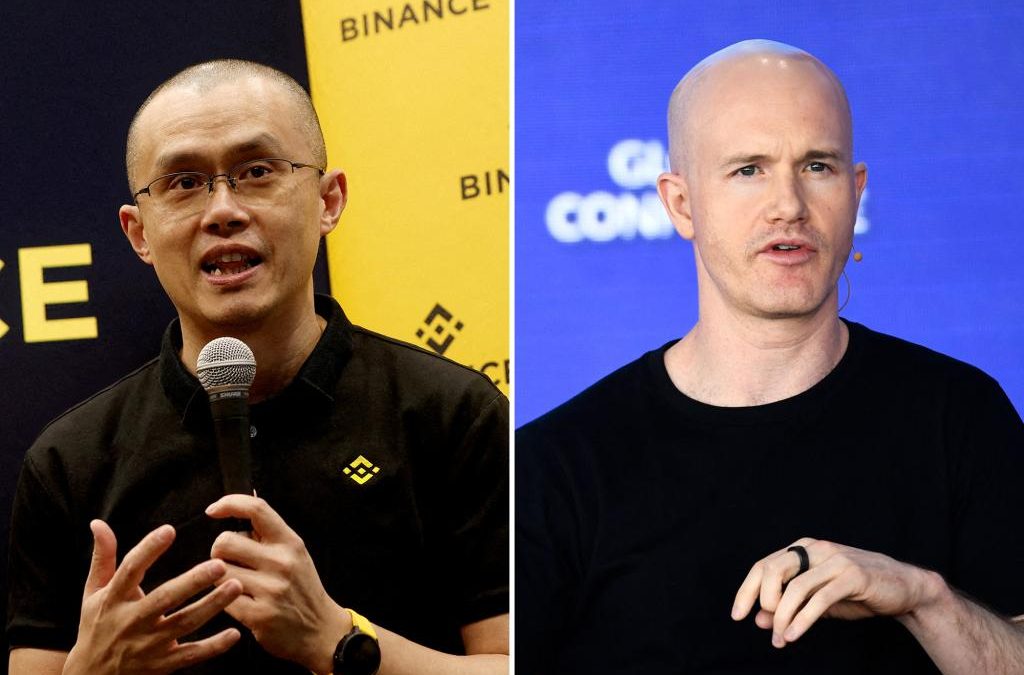

The Securities and Exchange Commission filed back-to-back lawsuits against Binance and Coinbase — the largest cryptocurrency exchanges in the world and in the US, respectively — causing billions to be slashed from their respective CEOs’ fortunes.

Binance CEO Changpeng Zhao saw his wealth dip by $1.4 billion to $26 billion over the past two days, according to Bloomberg.

Coinbase boss Brian Armstrong, meanwhile, took a $361 million hit to his net worth, which now sits at $2.2 billion, the outlet reported.

Both crypto chiefs were slapped with lawsuits this week for breaking the SEC’s securities rules, including failing to register with the regulatory agency, which sent shares of crypto and blockchain companies tumbling

The SEC sued Binance’s Zhao on Monday for allegedly operating a “web of deception,” listing 13 charges that accused the crypto mogul of secretly controlling customers’ assets and purportedly withholding information from regulations.

Binance created separate US entities “as part of an elaborate scheme to evade US federal securities laws,” the SEC also alleged.

Binance defended its platform “vigorously” in a blog post that noted the crypto company is “not a US exchange, [so] the SEC’s actions are limited in reach.”

In the 24 hours after the lawsuit was filed in Washington, D.C., on Monday, Binance’s token — Binance Coin (BNB) — tumbled more than 5% from the nearly $50 billion market value it enjoyed before the suit.

As of Wednesday, BNB — the fourth-largest cryptocurrency by market size — had a market capitalization of $42.9 billion, according to Binance’s website.

Coinbase also saw its value plummet after the SEC sued the US’ largest crypto exchange on Tuesday.

Just 24 hours after suing Binance, Wall Street’s top regulator sued Coinbase for allegedly acting as an unregistered broker.

The SEC’s complaint accused Coinbase of trading at least 13 unregistered crypto assets — including tokens Solana, Cardano, and Polygon — since 2019, profiting by billions off the illicit transactions.

Both civil cases are part of SEC Chair Gary Gensler’s efforts to assert more oversight over crypto markets, which he has called the “Wild West” of investing.

Coinbase’s enforcement chief Paul Grewal, though, insisted in a statement that the company has a “demonstrated commitment to compliance,” and said that it would continue business as usual.

After the SEC’s complaint was filed in US District Court for the Southern District of New York, shares of Coinbase parent company Coinbase Global fell as much as 21% as its value fell by more than $3 billion to $12.1 billion.

The losses reverberated through the crypto market.

The price of Bitcoin, by far the largest token by market cap, was trading at $25,710 on Tuesday — down about 4% from the day before, prior to the SEC’s lawsuits.

The second-largest token by value, Ethereum, also dipped nearly 3% during the same time period.

However, up until this week, crypto billionaires like 46-year-old Zhang and 40-year-old Armstrong saw their wealth skyrocket by $15.4 billion this year through Friday, according to Bloomberg.

Zhao’s fortune increased by a whopping 117% before the lawsuit-induced fall, while Armstrong’s was up 61%. For reference, other billionaires on the Bloomberg Billionaire Index were up a combined 9%.

Source